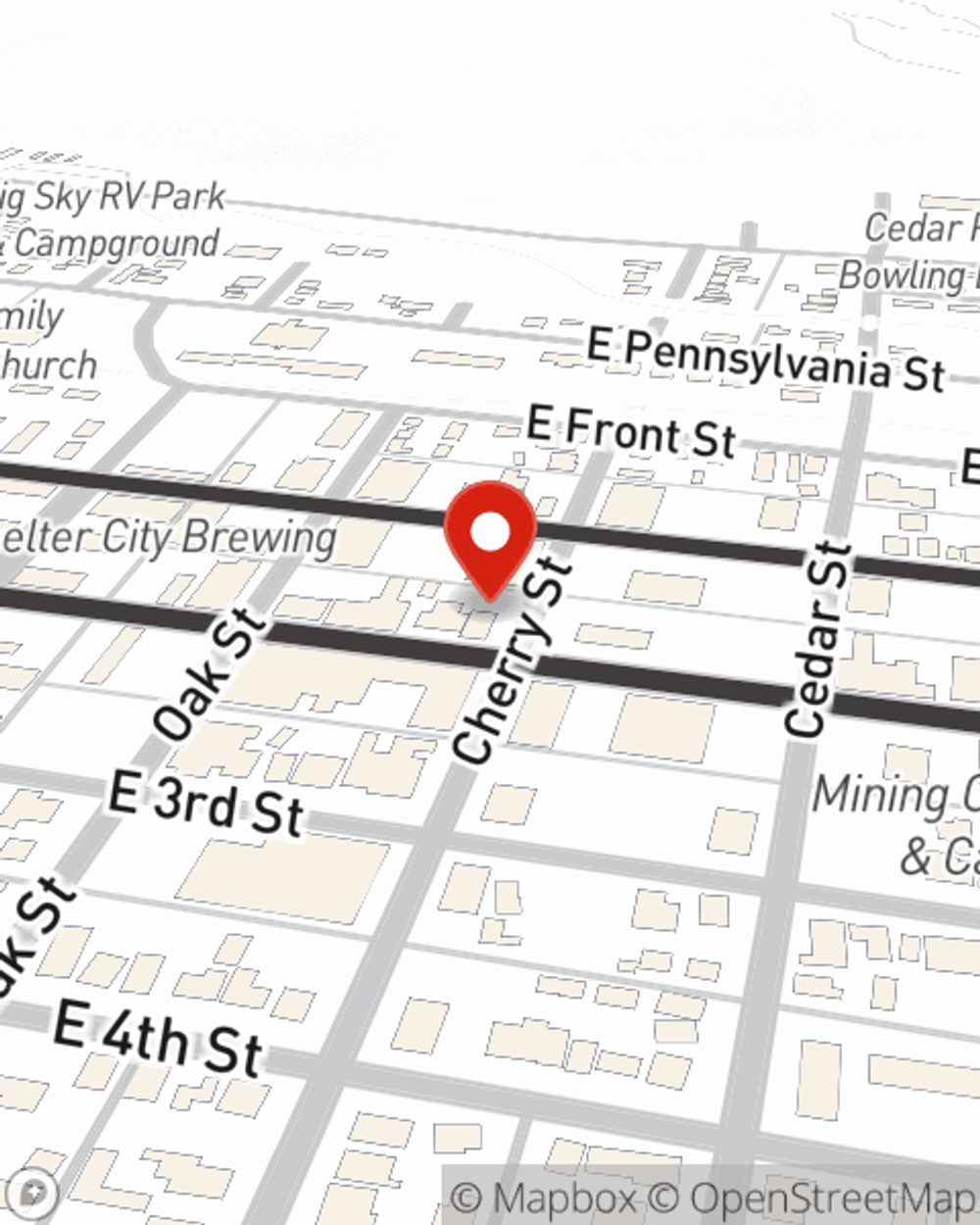

Renters Insurance in and around Anaconda

Looking for renters insurance in Anaconda?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

There’s No Place Like Home

There's a lot to think about when it comes to renting a home - internet access, number of bedrooms, price, condo or townhome? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Looking for renters insurance in Anaconda?

Coverage for what's yours, in your rented home

Why Renters In Anaconda Choose State Farm

When the unpredicted vandalism happens to your rented townhome or home, often it affects your personal belongings, such as a set of golf clubs, a tool set or a laptop. That's where your renters insurance comes in. State Farm agent Mike King has a true desire to help you choose the right policy so that you can protect your belongings.

It's never a bad idea to make sure you're prepared. Get in touch with State Farm agent Mike King for help understanding options for your policy for your rented unit.

Have More Questions About Renters Insurance?

Call Mike at (406) 563-2991 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.